Pronouncing what he called America’s new ‘Declaration of Independence’, US president Donald Trump on Wednesday unveiled sweeping tariffs on the world’s economies, excluding USMCA trading partners Canada and Mexico.

Speaking to a packed crowd in the Rose Garden of the White House, Trump ran the proceedings like a Bar Mitzvah host while a Marine Band played music.

In doing so, he vowed to ”Make America Wealthy Again” (MAWA) and deliver his long-awaited wrath on various enemies and foreign governments — including, but not restricted to his Two Amigos Canada and Mexico — although both trading partners were singled out for special derision.

“For decades our country has been looted, pillaged, raped and plundered by nations near and far,” by both allies and enemies, he added. “April 2, 2025 will forever be remembered as the day American industry was reborn.”

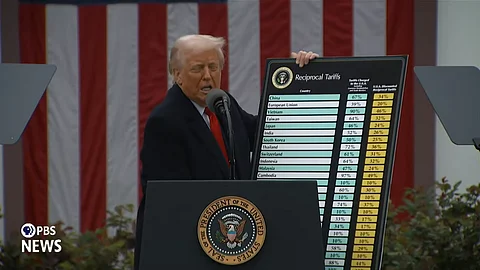

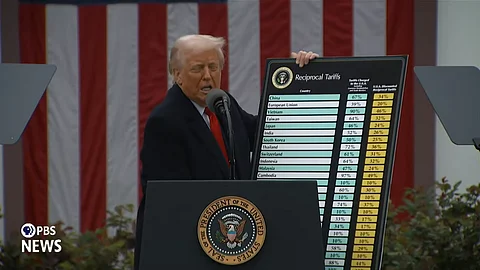

Trump signed an executive order after the ceremony. But brandishing a wooden plaque, Trump rattled off a preliminary list of “cheaters,” China 67%; EU 34%; Vietnam 90%; India 52%. The UK got off easy with 10%.

Trump said those “common sense” tariffs were ‘reciprocal’ and included value-added taxes and what he termed ‘currency manipulation’ in those calculations. Then said he was being “kind” by cutting that rate in half.

But for Canada and Mexico it could have been worse.

Even though both were spared ‘reciprocal’ tariffs — most goods from each country with few exceptions are already tariff free, with the exception of supply managed products like dairy — the existing fentanyl tariffs and auto tariffs continue to hold.

“For Canada and Mexico, the existing fentanyl/migration IEEPA orders remain in effect, and are unaffected by this order. This means USMCA compliant goods will continue to see a 0% tariff, non-USMCA compliant goods will see a 25% tariff, and non-USMCA compliant energy and potash will see a 10% tariff. In the event the existing fentanyl/migration IEEPA orders are terminated, USMCA compliant goods would continue to receive preferential treatment, while non-USMCA compliant goods would be subject to a 12% reciprocal tariff,” the White House said in a ‘Tariffs Fact Sheet’ issued after the presentation.

Despite trashing both Canada and Mexico, neither were included on the list. But the ‘reciprocal’ tariffs don’t include the ‘fentanyl’ tariffs — which are the subject of a US state of emergency that needs to be extended by Congress, or the 25% tariffs placed on automobile manufacturing.

Importers will now face tariffs as high as 49% based on how the White House is calculating duties on US exports, as well as "non-monetary" trade barriers based on countries doing things like manipulating their currencies or serving as "pollution havens."

In all, Trump said his tariff assault would raise USD$6 trillion for US government coffers.

The Canadian exemptions were noteworthy for what wasn’t included — namely 300% Canadian tariffs on supply managed agricultural products like dairy.

In addition, Trump has made noises that Canada’s official bilingualism was in effect a ‘non-monetary’ trade policy that amounts to a surcharge on products coming into this country from American manufacturers.

Last week, Liberal leader Mark Carney said Quebec’s language policies weren’t up for negotiation even though he intends to appeal its language laws to the Supreme Court.

Carney took the day off campaigning Wednesday to hunker down and formulated a Canadian response. He was expected to make a statement later Wednesday.

Meanwhile, it seems to extend a change in tone from Trump toward Canada in general. In what he described as a “productive” phone call with Carney last week, Trump again refrained from calling Canada the ‘51st State’ and referring to the prime minister as ‘governor’.

Wednesday’s announcement was made after the close of markets, which have taken a beating on successive tariff announcements.

But they reacted sharply in after-hours trading, suggesting a rough trading day on Thursday.

The S&P 500 plunged more than 2.7% while the Nasdaq slid more than 3.5%. The fund tracking the Dow indicated the NYSE big board would likely drop more than 415 points at tomorrow’s opening bell.

Asked if he was concerned by the market moves, Treasury Secretary Scott Bessent told Bloomberg that he’s “learned not to look at what goes on during after-hours markets.”

Bessent added that the Nasdaq has a “‘Mag7’ problem, not a MAGA problem,” referring to seven large tech stocks analysts refer to as the “Magnificent Seven.”

"I would advise none of the countries to panic," he added.