CRA to tax $2.5 billion small business carbon rebate despite Freeland's promise not to

The Canada Revenue Agency (CRA) is moving forward with taxing the $2.5 billion small business carbon tax rebate, despite assurances from the federal government that the payments would be tax-free.

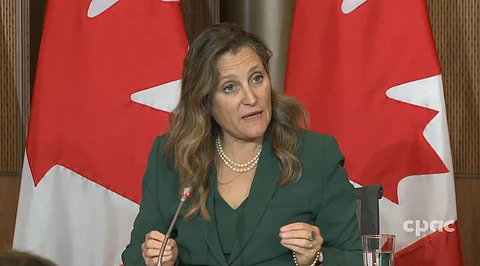

The decision, which contradicts a statement made by Finance Minister Chrystia Freeland in November, has sparked backlash from small business owners and industry advocates.

The Canadian Federation of Independent Business (CFIB) revealed that while the Department of Finance website still states that the Canada Carbon Rebate for Small Businesses is a “tax-free payment,” the CRA has confirmed in writing that the rebate will be subject to income tax.

The agency classifies the payments as “assistance received by the taxpayer from a government,” making them taxable unless new legislation is passed to exempt them.

CFIB President Dan Kelly criticized the decision, calling it a betrayal of small businesses.

“After waiting five years for the government to get around to rebating a share of carbon tax revenue to small businesses, we now learn that Ottawa will tax the tax rebate,” he said.

The rebates, paid out to 600,000 small businesses in December, averaged over $4,000 per recipient. Meanwhile, similar rebates given to Canadian families remain tax-free.

Only an act of Parliament can override the CRA’s decision, Kelly noted, urging the government to immediately reconvene Parliament to address the issue.

“This, on top of the need to prepare for the U.S. tariff threat, is another reason to resume Parliament immediately,” he added.

Small business opposition to the federal carbon tax remains strong, with CFIB reporting that 83% of business owners oppose the policy.

The organization is calling on the government to pass legislation ensuring the rebate remains tax-free, suspend the planned 19% carbon tax increase set for April 1, and return the small business rebate formula to 9% of total revenue with expanded access for unincorporated businesses.

CFIB, which represents 100,000 small and medium-sized businesses across Canada, continues to advocate for policy changes that support business growth and success.

The organization warns that the CRA’s decision could further strain already struggling small businesses, particularly as economic uncertainty looms ahead of the upcoming federal election.