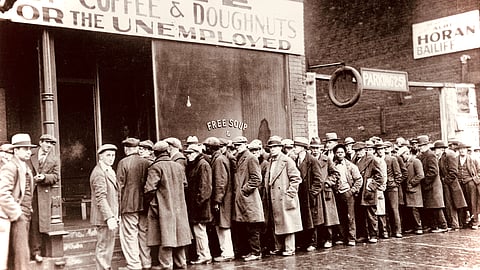

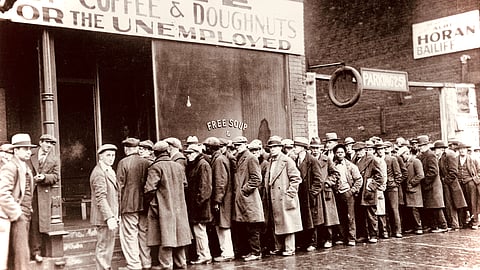

History repeats.

Financial experts on both sides of the border were warning of a second Great Depression after US president Donald Trump made good on his long promised tariff threats and went on the economic attack.

In a move reminiscent of the protectionist policies that exacerbated the Great Depression in the 1930s, Trump imposed punishing tariffs on major US trading partners including Canada, Mexico and China, triggering instant turmoil in global financial markets on Tuesday.

The Dow Jones was down more than 700 points at the open erasing all its post-election gains; NASDAQ dropped 284 points and the Toronto Stock Exchange shed more than 580 points or nearly 2.4%.

Gold was up USD$17.03 to $2,908.72 per ounce. West Texas Intermediate oil was down 84 cents to $67.53 per barrel; Western Canadian Select was off $1.97 to $54.80.

The only stock markets in positive territory on Tuesday were the Shanghai and Shenzen bourses in China.

Effective at midnight, a 25% tariff has been levied on imports from Canada and Mexico, alongside an increase in duties on Chinese goods from 10% to 20%.

Washington justifies these measures as necessary to combat the flow of fentanyl into the United States, declaring it a national emergency under the International Emergency Economic Powers Act (IEEPA) which Prime Minister Justin Trudeau on Tuesday called patently “false.”

The irony is that Trump in his first term used stock market performance as a proxy for the success of his fiscal policies.

Particularly affected were shares of major automakers and technology companies. General Motors and Ford saw their stocks fall by over 3% and 2%, respectively, amid concerns about increased production costs due to tariffs.

The McDonalds-owned Chipotle food chain ,which sources a significant portion of its avocados from Mexico, experienced a decline of more than 2%. Additionally, Nvidia, a leader in artificial intelligence, saw its stock fall by over 2%, contributing to a year-to-date loss of approximately 17%.

Meanwhile, the international response has been swift.

Canada announced retaliatory tariffs on $155 billion worth of U.S. goods. Mexico is also expected to announce countermeasures, further escalating the potential for a full-scale trade war.

Economists warn that these actions could lead to a downward economic spiral similar to the 1930s, when protectionist tariffs deepened the global economic downturn and ultimately led to the Second World War.

Andrew Wilson, deputy secretary-general of the International Chamber of Commerce, expressed deep concern, stating that this could mark the beginning of a “downward spiral” reminiscent of the 1930s trade wars.

The tariffs are expected to have widespread implications for various sectors, particularly the automotive industry, which relies heavily on integrated supply chains across North America.

The American Automotive Policy Council has expressed concern that these tariffs could undermine the competitiveness of US automakers and lead to increased costs for consumers.

“We continue to believe that vehicles and parts that meet the USMCA’s stringent domestic and regional content requirements should be exempt from the tariff increase. Our American automakers, who invested billions in the US to meet these requirements, should not have their competitiveness undermined by tariffs that will raise the cost of building vehicles in the United States and stymie investment in the American workforce, while our competitors from outside of North America benefit from easy access to our home market,” said AAPC president Matt Blunt.

Meanwhile Trump falsely continued to insist that US banks are not able to operate in Canada.

“Canada doesn’t allow American Banks to do business in Canada, but their banks flood the American Market. Oh, that seems fair to me, doesn’t it?” the he wrote on Truth Social.

That sent shares of the largest American banks plummeting. The four largest lenders in the U.S., also known as ‘money centre banks’ for their role in the global economy, suffered sharp losses Tuesday. Citibank tumbled as much as 8% Tuesday, Wells Fargo was down 6.8%, Bank of America slumped 6.5% and JP Morgan retreated 5.2%.

As of Tuesday, Citigroup was down about 18.3% from its mid-February 52-week high; Wells Fargo was off 12.1% from its early February high; Bank of America and JPMorgan had also fallen 11.9% and 11.8%, respectively, from recent highs.