Eliminating Canada's second income tax bracket by replacing it with an extended first bracket would save more than 8.5 million middle-class Canadians $17 billion, says an economic note by the Montreal Economic Institute.

“Taxes, high inflation and now economic uncertainty have all taken their toll on the Canadian middle class in recent years,” said Jason Dean, Associate Researcher at the MEI and author of the publication. “Working Canadians need a real reduction in the tax burden, and gimmicks like a GST vacation or an extremely targeted tax credit are no longer enough.”

Between 2015 and 2023, Canadian employment income grew by about 5.2 % (expressed in US dollars, using purchasing power parity). American employment income grew almost twice as fast, coming in at 9.7% over the same period.

This earnings gap is especially noticeable in our major cities. The median income of Torontonians is now 26% lower than that of Chicagoans. Vancouverites earn 39% less than Seattleites, and Montrealers earn 40% less than Bostonians.

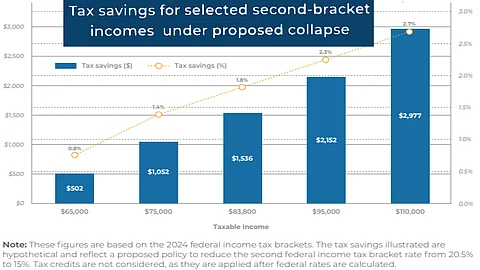

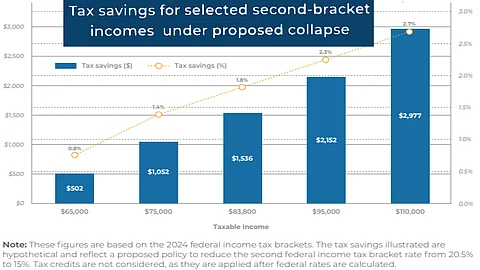

The MEI researcher recommends easing the pressure on households by reducing the rate on the second tax bracket from 20.5% to 15%, thereby creating a single rate for taxable incomes up to $111,733.

For the more than 8.5 million Canadian middle-class workers and retirees with incomes between $55,867 and $111,733, this would mean a drop in their marginal tax rate of 5.5%. The proposal would put an estimated $17.9 billion back into the pockets of Canadian taxpayers.

Economic studies show that tax cuts have a significant stimulating effect, boosting prosperity for middle-class taxpayers as well as for those less well-to-do.

Taxpayers whose income level is just slightly below the target zone would see some of the most positive effects, as the tax wall standing in front of them would be eliminated.

“The less we penalize work, the more workers will tend to want to improve their situation and their career,” explains Dean. “By abolishing the tax bracket specific to the middle class, the federal government would punish effort less and help workers by leaving them a larger share of their wages.”

This reform would help Canada compare less poorly against the U.S. Americans start with lower rates of 10% and 12% on income up to US$47,150 (C$66,898.50) for singles, with married couples filing jointly staying at just 12% on income up to US$94,300 (C$133,800.64).

Canada slipped from 24th to 31st in global personal tax competitiveness in 2024, while the US climbed from 22nd to 17th.

The MEI’s economic note is available here.

The MEI is an independent public policy think tank with offices in Montreal, Calgary, and Ottawa.